Best Small Business Accounting Software for Enterprises

The three best small business accounting software online for small businesses & enterprises.

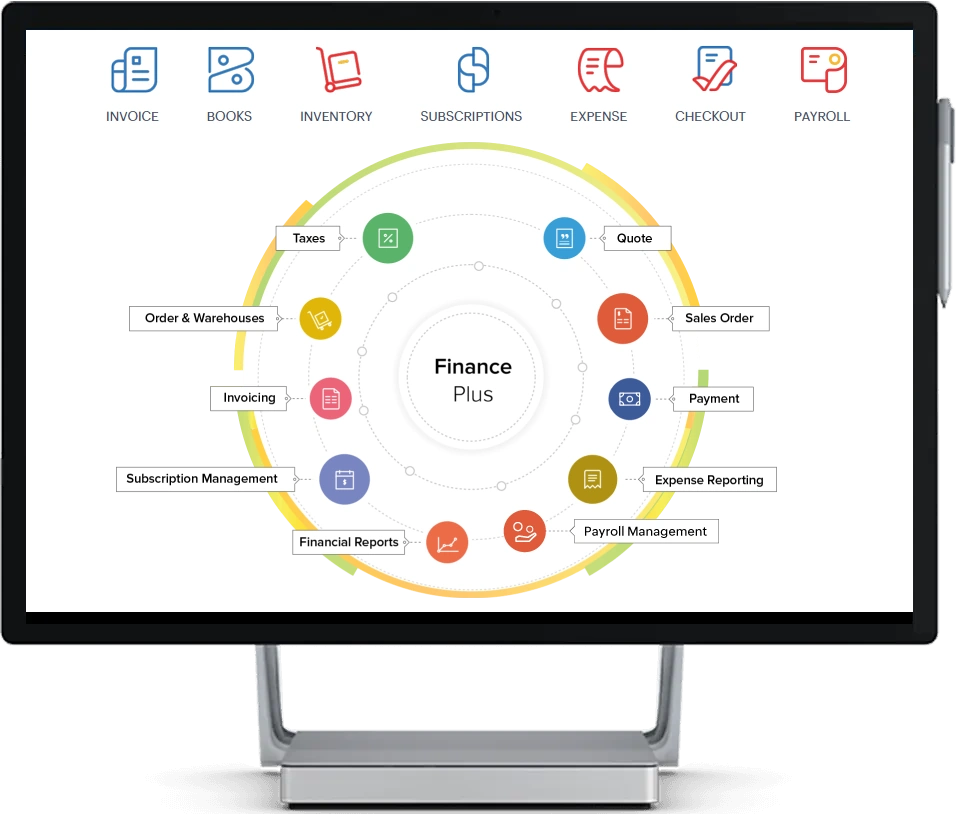

Zoho Finance Plus provides everything you need to manage your business operations and finances from quote to cash process, expenses, order management, inventory & subscriptions.

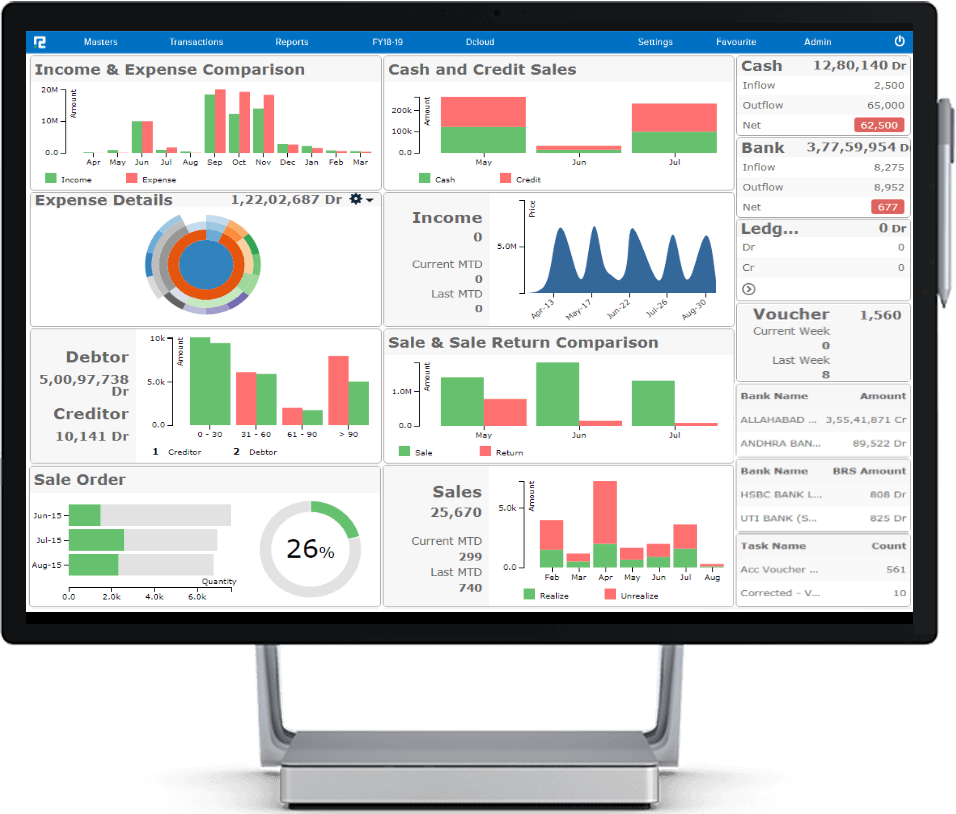

Realbooks is a business intelligence accounting software and tool with four different editions. The RealBooks Business Edition is best suited for enterprises.

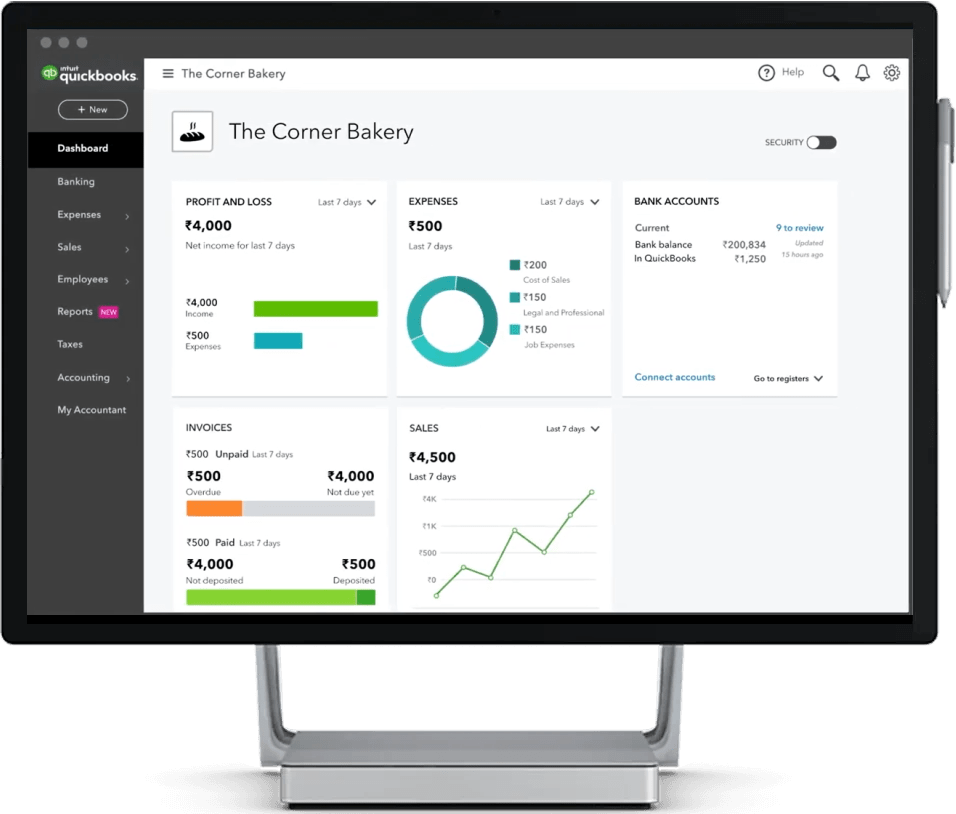

Quickbooks online comes with Simple, Essential, Plus and Advanced version for small business accounting with inventory tracking, project profitability and detailed reporting.

Defining Small Business Accounting Software

Small Business Accounting Software for Mid Market & Micro, Small & Medium Enterprises

What is a small business accounting software and how is it different from any other accounting software?

Small business accounting software derives from a segment of the business that usually belongs to the family of Micro Small and Medium Enterprises. The term Small Business mostly relates to industries and enterprises and they are preferably small manufacturers with limited production capabilities.

Most small businesses also work as a subcontractor, therefore they need business software that not only supports accounting but inventory management as well. Therefore small business accounting software is often complex to define.

However, manufacturers need a scalable accounting system that not only supports core accounting or inventory but integrates with other aspects of business such as expenses, payroll, projects, order-to-cash, procure-to-pay life cycle management, etc.

While there are a lot of other commercial accounting software packages, not all accounting software belongs to a family of small businesses, and that too particularly on the cloud. Accounting software online is critical for small businesses in case there is a need for customization. Therefore readily available online accounting software that is scalable may seem to be beneficial.

For example, Zoho Finance Plus, Quickbooks Online, and RealBooks are some of the best accounting software for Small Business that mostly caters to the needs of businesses, industries, and industrial enterprises.

Small business accounting software is one of the most efficient accounting systems that are applicable for micro, small, and mid enterprises and businesses because it has more features and capabilities that industries need to survive and thrive.

Small businesses also need an accounting system to support complete sales, purchase, inventory, payroll, and manufacturing to some extent as an integrated solution.

1. Zoho Finance Plus for Small Business

Zoho Finance Plus is a suite of online financial tools that allow users to manage their finances in a simple, easy-to-use interface..

The platform offers a variety of features, including budgeting and tracking, debt management, and investment analysis.

It also has a payment tracker, so users can see how much they have paid in each category over time.

Other features of Zoho Finance Plus:

☑ Loans Pre-approval

☑ Credit Score Monitoring

☑ Platform Integrations and more

Defining Zoho Finance Plus

Integrated Financial Software for Small Business. A GST Complaint financial suite designed to streamline the financial process for small businesses. Zoho Finance Plus also offers features such as fraud detection and reporting, automated payments, and automatic reconciliation of bank accounts.

Several programs, one platform

Zoho Finance applications are configured to operate together seamlessly to keep all information synchronized. The information that is entered in one app will be reflected on every other application, ensuring your data is kept current at all times.Quote to Cash Process

When one salesperson generates the quote and the order on a specific app, that is usually immediately available to appropriate teams to promptly process the order and invoice the customer, or collect payment.Saas/Subscription Based

With a subscription business model, Zoho Finance Suite provides an ongoing transaction management system and helps bridge the divide between traditional accounting and subscription billing.Fast employee reimbursements

Zoho Expense automates your reimbursement approval flow, making it easy for your employees to claim reimbursements. All of their expenses fall into the appropriate accounts automatically.Fully GST-compliant solution

Zoho finance plus programs are optimized to deal with the single taxation structure of GST to make filing taxes as fast and easy as it possible with tax portals integration.Administrative ease

The intuitive administrative console makes it simple to oversee many customers and employees across numerous departments. It is possible to add role-based authorization to several functions within a manageable location.2. RealBooks for Small Business

Plan, manage and analyze your business and finances with small business accounting software.

Manage Simple to Complex Inventory & Handle Complex Production Life Cycles

Business Intelligence Redefined for Small Business & Enterprises

Manage your Entire Business with Multi Branches & Companies under a single roof

☑ TCS / TDS Compliant

☑ E-Invoicing Compliant

☑ GST Compliant

RealBooks is Cloud-Based & SaaS

RealBooks is a small business accounting, inventory, and payroll software that is truly user-friendly, advanced, and built for scale. RealBooks also supports advanced inventory management, job work, and manufacturing processes that are beneficial for industrial manufacturers to adopt RealBooks accounting software. A lot of entrepreneurs, businesses, and enterprises have successfully implemented RealBooks over the years on the cloud making their data more transparent in business, resolving loopholes faster, and collaborating with their teams. Therefore we have tried to answer some of the common myths that bound small businesses to adopt cloud accounting software.

Is it safe to put the confidential financial data on the cloud?

It is simple to understand that it is none safer than having your money with a Bank. RealBooks uses world-class infrastructure provided by Amazon to secure your financial data.

Is it better to keep a local copy of our data too?

In our opinion, there is no need as we are taking continuous backups of your data and archiving them on the cloud. However, if you wish to retain a copy of your data in Excel or Tally format you can always download it from the system.

Are the bank/ card details secured?

Since no payment are processed from RealBooks, we do not store your credit card/bank transaction credentials.

RealBooks Business Accounting Software

Scalable & Cutting Edge Features for Small Business, Industries & Enterprises

Multiple Company & Branches

Create unlimited companies and branches, Get consolidated reports for all branches, Auto posting for inter-branch entries, Define permissions for users in various branches.Multiple Profit & Cost Centres

Manage multiple cost centres / profit centres, Map transactions with two groups simultaneously, Get profitability statement for profit / cost groups, View reports filtered by profit / cost centre.Simple Uptodate Compliance

Stay up-to-date with changing compliances, Set up to automatically compute GST and TDS, View reports for GST and TDS payments, Generate reports for GST and TDS returns.Perfect Reports

Know the details of your business accurately Get profitability of company, branch, project Track payables and receivables easily Monitor productivity with order & sales reportPaperless Office

Upload bills to cloud directly or via dropbox, Define rules for approving bills for payments, Retrieve old uploaded bills / documents, Centralise book keeping.Scheduled Notifications

Get intelligent notifications on mails, Set rules for notifications on transactions, Get RealBooks to send you automated reports, Set up schedule for receiving various reports.Dashboard

Know your company's finances at a glance, Analyse profitability of branches & projects, Budget money with a summary of dues, Know the status of compliances done.Built for Large Teams

You grow and RealBooks scales with you, RealBooks can easily handle millions of records, Define permissions and restrict access to data, Restrict back dated entries and edits.Fully Controlled

Access your books anytime and anywhere, Restrict User Access out of office, Integrate your Office, Factory and Retail Outlet, Use iOS and Android Apps on the go.Full Fledge DMS System to Upload Documents to the Cloud

DIRECTLY OR VIA DROPBOX

RealBooks Accounting Software Modules

Simplify your business with Accounting, Payments, and Payroll working together.

Simplify your business with Accounting, Payments, and Payroll working together.

Upload Offer Letters, Employee Documents

Leave Management

Advances & Adjustments

Flexible Salary Structures

Salary Calculation

Branch Wise Salary Processing

Upload Investment Declarations

Automated Mailers for Pay Slips

Employee Log-In for Accessing Salary Slips

Sync Data Automatically to Accounts

Compliance Reports

Time Sheets for Project Costing & Profitability

Better Control on Manufacturing, Complex Inventory & Order Management

Order Management

Get real time control of the inventory process, track goods through every stage of operation. Give PO to suppliers, fulfil order through GRN, book invoice against GRN, track sales order from customers and pending order

Inventory Management

Track stocks across multiple warehouses in locations around the world, all in real time. Record & track job orders, material movement, job charges and stock conversion. Maintain warehouse wise stock positions. Issue store items on RGP/NRGP basis

Manufacturing Accounting

Manage bill of material, manufacturing journals, track cost of associated resources, batch management, quality control, production orders, multi process manufacturing, delivery schedule and more with cloud manufacturing

GST Implementation in RealBooks

Make Seamless Return Filing Experience With the GSTN Portal

☑ GST Ready

With Realbooks you get an integrated, simple GST complaint Online Accounting System. We have updated our systems to track all information needed to have a seamless return filing experience with the GSTN. Keep the RealBooks GST set up simple and remember to put the right tax ledgers in every transaction or let us do the heavy lifting and put a one-time effort to set up the masters.

☑ Multiple Business Places & GSTINs

Record Business place in all transactions to track accurately from which GSTIN the supply has taken place where there are multiple registrations due to multiple locations or multiple business verticals.

☑ Party Ledgers

Record all Customers GSTIN data, category of registration and place of supply. GSTIN data will help you know if you are supplying to a registered person or a consumer. Category of registration helps you track if you are supplying to a normal registered person, government organization, e-commerce operator or exporting. When you supply to eCommerce Operator claim input credit on Tax Collected at Source or when you supply to Government organization claim input credit on Tax Deducted at Source. Place of supply will help in determining the type of supply for determining the GST chargeable. Whether it is an inter-state supply requiring IGST or an intra-state supply requiring CGST and SGST or UGST as the case may be.

☑ Tax Ledgers

Mark Tax ledgers and add rates to these ledgers so that the GST calculations can be done automatically. Track Reverse Credit ledgers and credit thereof. Set off the Output liabilities with the corresponding input credit in the right sequence. Output SGST / UGST with Input SGST / UGST and input IGST Output CGST with Input CGST and input IGST Output IGST with Input IGST and input CGST and input SGST / UGST

☑ Output Tax on Supply of Goods

Record HSN code against all items and map items to the correct tax ledgers with the right rates for automatic calculations of GST. Track item wise / HSN wise tax liability for correct Tax Invoice printing and uploading to GSTN.

☑ Output Tax on Supply of Services

Record Service Accounting Code against all income ledgers and further map income ledgers to the correct tax ledgers with the right rates for automatic calculations of GST. Track income ledger / SAC wise tax liability for correct Tax Invoice printing and uploading to GSTN.

☑ Bill of supply

Raise Bill of Supply in a separate voucher series where the supplies are exempt from tax or are nil rated supplies.

☑ Input Tax on Goods & Services Received

Upload and Record the invoices as they come from the supplier. If the supplier is unregistered or a foreign supplier, RealBooks can help you to put RCM entries on such purchases. Mark services where RCM is to be paid on the supply made to you. And track the set-off of credit only upon payment of such liability arising about of RCM.

☑ Advance Receipts

Maintain a separate series for of Tax Invoice for taking advances from the customers and adjust them against the appropriate Tax Invoices on actual Supplies.

☑ Debit Note & Credit Note

Maintain a separate series for of Tax Invoice for Debit Notes / Credit Notes raised on customers and adjust them against the appropriate Tax Invoices issued earlier.

3. Quickbooks Online for Small Business

Intuit's QuickBooks Online is a cloud-based accounting software that is designed for small businesses.

QuickBooks Online offers a comprehensive set of features and functionality that is just as suitable for larger businesses as it is for smaller ones

You can access it from any device with an internet connection, so you can stay on top of your finances from anywhere.

Other features of Quickbooks online are:

☑ Robust Inventory & Invoicing features

☑ Track Sales & Expenses

☑ Collaboration with team members