Best Small Business Accounting Software for Enterprises

The 3 best small business accounting software for micro, small & medium enterprises

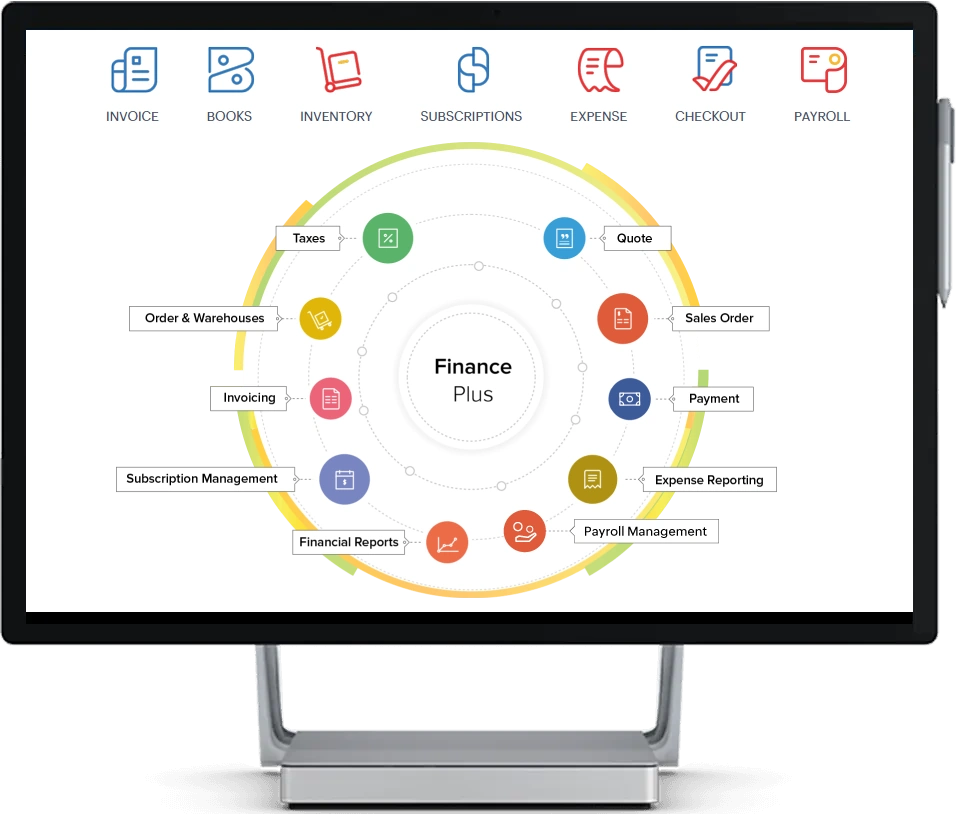

Zoho Finance Plus provides everything you need to manage your business operations and finances from quote to cash process, expenses, order management, inventory & subscriptions.

Realbooks is a business intelligence accounting software and tool with four different editions. The RealBooks Business Edition is best suited for enterprises.

Tally Prime is truly a small business accounting software for any kind of business. It is primarily a desktop application with SSP and remote access features for online connectivity.

Defining Small Business Accounting Software

Small Business Accounting Software for Mid Market & Micro, Small & Medium Enterprises

What is a small business accounting software and how is it different from other software for accounting?

Small business accounting software derives from a segment of the business that usually belongs to the family of Micro Small and Medium Enterprises. The term Small Business mostly relates to industries and enterprises and they are preferably small manufacturers with limited production capabilities.

Most small businesses also work as a subcontractor, therefore they need business software that not only supports accounting but inventory management as well. Therefore small business accounting software is often complex to define.

However, manufacturers need a scalable accounting system that not only supports core accounting or inventory but integrates with other aspects of business such as expenses, payroll, projects, order-to-cash, procure-to-pay life cycle management, etc.

While there are a lot of other commercial accounting software packages, not all accounting software belongs to a family of small businesses, and that too particularly on the cloud. Accounting software online is critical for small businesses in case there is a need for customization. Therefore readily available online accounting software that is scalable may seem to be beneficial.

For example, Zoho Finance Plus, Quickbooks Online, and RealBooks are some of the best accounting software for Small Business that mostly caters to the needs of businesses, industries, and industrial enterprises.

Small business accounting software is one of the most efficient accounting systems that are applicable for micro, small, and mid enterprises and businesses because it has more features and capabilities that industries need to survive and thrive.

Small businesses also need an accounting system to support complete sales, purchase, inventory, payroll, and manufacturing to some extent as an integrated solution.

1. Zoho Finance Plus for Small Business

Zoho Finance Plus is a suite of online financial tools that allow users to manage their finances in a simple, easy-to-use interface..

The platform offers a variety of features, including budgeting and tracking, debt management, and investment analysis.

It also has a payment tracker, so users can see how much they have paid in each category over time.

Some unique features of Zoho Finance Plus are:

☑ Loans Pre-approval

☑ Credit Score Monitoring

☑ Platform Integrations and more

Zoho Finance Plus Features

Integrated Financial Software for Small Business. A GST Complaint financial suite designed to streamline the financial process for small businesses. Zoho Finance Plus also offers features such as fraud detection and reporting, automated payments, and automatic reconciliation of bank accounts.

Several programs, one platform

Zoho Finance applications are configured to operate together seamlessly to keep all information synchronized. The information that is entered in one app will be reflected on every other application, ensuring your data is kept current at all times.Quote to Cash Process

When one salesperson generates the quote and the order on a specific app, that is usually immediately available to appropriate teams to promptly process the order and invoice the customer, or collect payment.Saas/Subscription Based

With a subscription business model, Zoho Finance Suite provides an ongoing transaction management system and helps bridge the divide between traditional accounting and subscription billing.Fast employee reimbursements

Zoho Expense automates your reimbursement approval flow, making it easy for your employees to claim reimbursements. All of their expenses fall into the appropriate accounts automatically.Fully GST-compliant solution

Zoho finance plus programs are optimized to deal with the single taxation structure of GST to make filing taxes as fast and easy as it possible with tax portals integration.Administrative ease

The intuitive administrative console makes it simple to oversee many customers and employees across numerous departments. It is possible to add role-based authorization to several functions within a manageable location.All In One Zoho Finance Plus Modules

Get Ready To Use Modules integrated with Zoho Finance Plus such as Zoho Inventory, Payroll, Books, Invoice, Billing and Expenses and Checkout Module.

☑ Zoho Invoice

Zoho Invoice simplifies invoicing processes by allowing users to create professional invoices effortlessly with customizable templates. It also facilitates efficient project management by enabling users to track time and manage projects seamlessly. Additionally, Zoho Invoice automates payment reminders and supports online payments, streamlining the invoicing and payment collection process for businesses.

☑ Zoho Books

Zoho Books is a comprehensive online accounting software designed for small businesses. It streamlines financial management, automates workflows, and ensures compliance. With features like invoicing, expense tracking, and robust reporting, Zoho Books simplifies accounting tasks, enabling businesses to focus on growth and profitability

☑ Zoho Inventory

Zoho Inventory is a comprehensive inventory management software tailored for Indian businesses. It streamlines order management, GST billing, warehouse oversight, and integrates with platforms like Shopify and Zoho CRM. Key features include e-invoicing, barcode scanning, and real-time inventory tracking. With a range of pricing plans and mobile app support, it serves MSMEs to large corporations efficiently.

☑ Zoho Billing

Zoho Billing is versatile GST billing software suitable for various business models, including financial services, marketing, and SaaS. It optimizes financial processes with features like product management, e-invoicing, and flexible payment handling. Users benefit from powerful business insights, seamless customer lifecycle management, and extensive customization. Zoho Billing integrates with multiple platforms, offers mobile access, and provides transparent pricing plans, all while ensuring robust data security. Trusted globally, it enhances billing efficiency and supports business growth.

☑ Zoho Expense

Zoho Expense conquers chaos, streamlines spending, and manages travel and expenses from one place. Capture receipts on the go, automate reports with a tap, and gain real-time insights – all in one place. No more manual entry, lost receipts, or confusing spreadsheets. Zoho Expense keeps your team on track, simplifies approvals, and lets you focus on what matters – running your business.

☑ Zoho Checkout

Zoho Checkout module simplifies online payment collection with a user-friendly approach tailored to businesses of all sizes. It is designed to eliminate the complexities of coding allowing users to create personalized, branded payment pages swiftly. These pages support both one-time and recurring payments, with customization options that include templates, branding elements, and secure SSL encryption for customer data protection. Zoho Checkout integrates seamlessly with various payment gateways, ensuring flexibility and global accessibility. It also offers real-time analytics for businesses to track payments efficiently. Therefore Zoho Checkout offers scalable plans to meet diverse business needs, making it an ideal choice for anyone seeking reliable, hassle-free online payment solutions.

☑ Zoho Payroll

Zoho Payroll revolutionizes payroll management with its intuitive and scalable software, aimed at simplifying processes for businesses in India. Offering a seamless transition from spreadsheets to a cloud-based platform, Zoho Payroll saves significant operational time—up to 70% for its users. It ensures hassle-free migration and integrates HR, payroll, and accounting functionalities into a unified ecosystem. Features include automatic payroll calculations, diverse compensation structures, timely salary payments directly to bank accounts, and robust compliance with Indian tax regulations. The platform enhances employee self-service with an ESS portal and provides fine-grained admin privileges for streamlined administration. Backed by integrated banking partnerships and lauded for its user-friendly interface and customer support, Zoho Payroll stands out as the preferred choice for efficient payroll management in India.

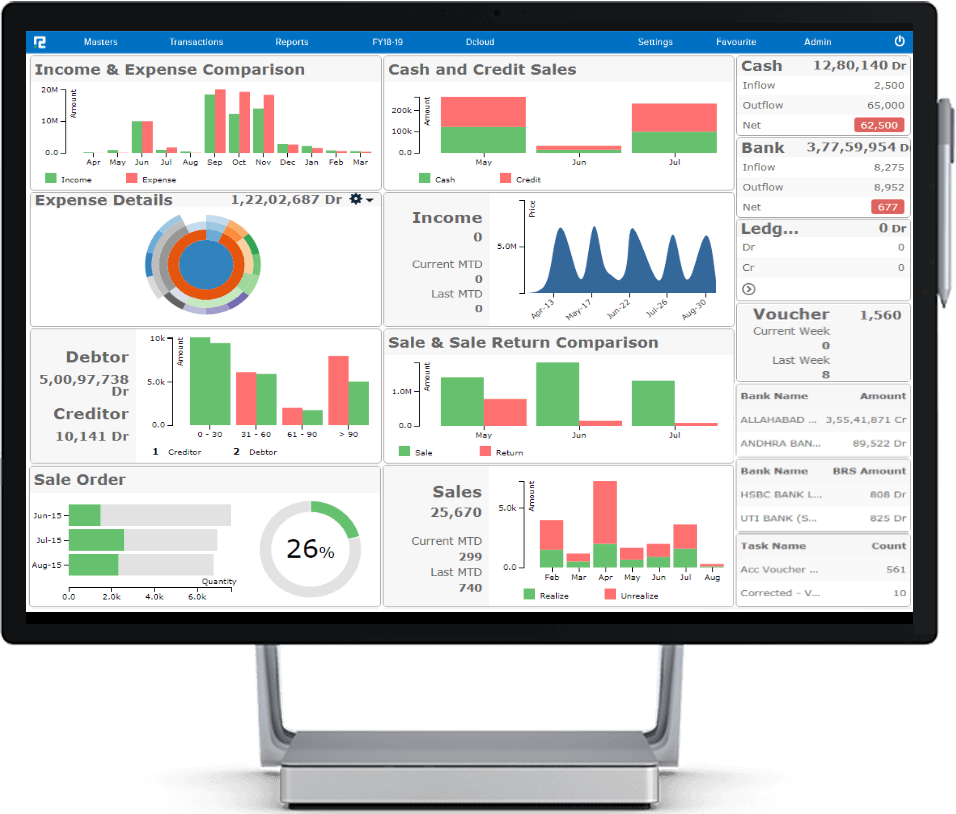

2. RealBooks for Small Business

Plan, manage and analyze your business and finances with small business accounting software.

Manage Simple to Complex Inventory & Handle Complex Production Life Cycles

Business Intelligence Redefined for Small Business & Enterprises

Manage your Entire Business with Multi Branches & Companies under a single roof

Some unique features of RealBooks are.

☑ Document Management

☑ Specialized for Auto Dealers

☑ WhatsApp Integration

100% Cloud-Based Small Business Accounting Software

RealBooks is a small business accounting, inventory, and payroll software that is truly user-friendly, advanced, and built for scale. RealBooks also supports advanced inventory management, job work, and manufacturing processes that are beneficial for industrial manufacturers to adopt RealBooks accounting software. A lot of entrepreneurs, businesses, and enterprises have successfully implemented RealBooks over the years on the cloud making their data more transparent in business, resolving loopholes faster, and collaborating with their teams. Therefore we have tried to answer some of the common myths that bound small businesses to adopt cloud accounting software.

Frequently Asked Questions

Is it safe to put the confidential financial data on the cloud?

It is simple to understand that it is none safer than having your money with a Bank. RealBooks uses world-class infrastructure provided by Amazon to secure your financial data.

Is it better to keep a local copy of our data too?

In our opinion, there is no need as we are taking continuous backups of your data and archiving them on the cloud. However, if you wish to retain a copy of your data in Excel or Tally format you can always download it from the system.

Are the bank/ card details secured?

Since no payment are processed from RealBooks, we do not store your credit card/bank transaction credentials.

RealBooks Accounting Software Features

Scalable & Cutting Edge Features for Small Business, Industries & Enterprises

Full Fledge DMS System to Upload Documents to the Cloud

Directly Or Via DropBox

Multiple Companies & Branches

Create unlimited companies and branches, Get consolidated reports for all branches, Post for inter-branch entries, and Define permissions for users in various branches.

Multiple Profit & Cost Centres

Manage multiple cost centres / profit centres, Map transactions with two groups simultaneously, Get profitability statement for profit / cost groups, View reports filtered by profit / cost centre.

Simple Uptodate Compliance

Stay up-to-date with changing compliances, Set up to automatically compute GST and TDS, View reports for GST and TDS payments, Generate reports for GST and TDS returns.

Perfect Reports

Know the details of your business accurately Get profitability of company, branch, project Track payables and receivables easily Monitor productivity with order & sales report

Paperless Office

Upload bills to cloud directly or via dropbox, Define rules for approving bills for payments, Retrieve old uploaded bills / documents, Centralise book keeping.

Scheduled Notifications

Get intelligent notifications on mails, Set rules for notifications on transactions, Get RealBooks to send you automated reports, Set up schedule for receiving various reports.

Dashboard

Know your company's finances at a glance, Analyse profitability of branches & projects, Budget money with a summary of dues, Know the status of compliances done.

Built for Large Teams

You grow and RealBooks scales with you, RealBooks can easily handle millions of records, Define permissions and restrict access to data, Restrict back dated entries and edits.

Fully Controlled

Access your books anytime and anywhere, Restrict User Access out of office, Integrate your Office, Factory and Retail Outlet, Use iOS and Android Apps on the go.

RealBooks Accounting Software Modules

Simplify your business with Accounting, Payments, and Payroll working together.

Upload Offer Letters, Employee Documents

Leave Management

Advances & Adjustments

Flexible Salary Structures

Salary Calculation

Branch Wise Salary Processing

Upload Investment Declarations

Automated Mailers for Pay Slips

Employee Log-In for Accessing Salary Slips

Sync Data Automatically to Accounts

Compliance Reports

Time Sheets for Project Costing & Profitability

Better Control on Manufacturing, Complex Inventory & Order Management

Order Management

Get real time control of the inventory process, track goods through every stage of operation. Give PO to suppliers, fulfil order through GRN, book invoice against GRN, track sales order from customers and pending order

Inventory Management

Track stocks across multiple warehouses in locations around the world, all in real time. Record & track job orders, material movement, job charges and stock conversion. Maintain warehouse wise stock positions. Issue store items on RGP/NRGP basis

Manufacturing Accounting

Manage bill of material, manufacturing journals, track cost of associated resources, batch management, quality control, production orders, multi process manufacturing, delivery schedule and more with cloud manufacturing

GST Implementation in RealBooks

Make Seamless Return Filing Experience With the GSTN Portal

☑ GST Ready

With Realbooks you get an integrated, simple GST complaint Online Accounting System. We have updated our systems to track all information needed to have a seamless return filing experience with the GSTN. Keep the RealBooks GST set up simple and remember to put the right tax ledgers in every transaction or let us do the heavy lifting and put a one-time effort to set up the masters.

☑ Multiple Business Places & GSTINs

Record Business place in all transactions to track accurately from which GSTIN the supply has taken place where there are multiple registrations due to multiple locations or multiple business verticals.

☑ Party Ledgers

Record all Customers GSTIN data, category of registration and place of supply. GSTIN data will help you know if you are supplying to a registered person or a consumer. Category of registration helps you track if you are supplying to a normal registered person, government organization, e-commerce operator or exporting. When you supply to eCommerce Operator claim input credit on Tax Collected at Source or when you supply to Government organization claim input credit on Tax Deducted at Source. Place of supply will help in determining the type of supply for determining the GST chargeable. Whether it is an inter-state supply requiring IGST or an intra-state supply requiring CGST and SGST or UGST as the case may be.

☑ Tax Ledgers

Mark Tax ledgers and add rates to these ledgers so that the GST calculations can be done automatically. Track Reverse Credit ledgers and credit thereof. Set off the Output liabilities with the corresponding input credit in the right sequence. Output SGST / UGST with Input SGST / UGST and input IGST Output CGST with Input CGST and input IGST Output IGST with Input IGST and input CGST and input SGST / UGST

☑ Output Tax on Supply of Goods

Record HSN code against all items and map items to the correct tax ledgers with the right rates for automatic calculations of GST. Track item wise / HSN wise tax liability for correct Tax Invoice printing and uploading to GSTN.

☑ Output Tax on Supply of Services

Record Service Accounting Code against all income ledgers and further map income ledgers to the correct tax ledgers with the right rates for automatic calculations of GST. Track income ledger / SAC wise tax liability for correct Tax Invoice printing and uploading to GSTN.

☑ Bill of supply

Raise Bill of Supply in a separate voucher series where the supplies are exempt from tax or are nil rated supplies.

☑ Input Tax on Goods & Services Received

Upload and Record the invoices as they come from the supplier. If the supplier is unregistered or a foreign supplier, RealBooks can help you to put RCM entries on such purchases. Mark services where RCM is to be paid on the supply made to you. And track the set-off of credit only upon payment of such liability arising about of RCM.

☑ Advance Receipts

Maintain a separate series for of Tax Invoice for taking advances from the customers and adjust them against the appropriate Tax Invoices on actual Supplies.

☑ Debit Note & Credit Note

Maintain a separate series for of Tax Invoice for Debit Notes / Credit Notes raised on customers and adjust them against the appropriate Tax Invoices issued earlier.

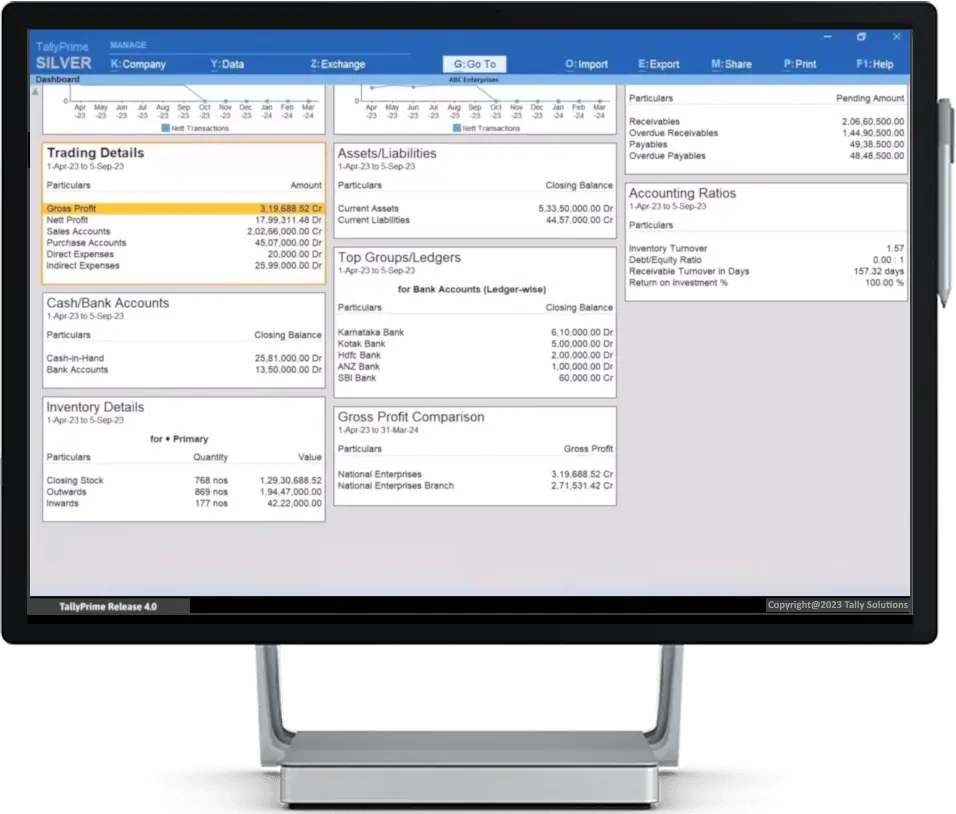

3. Tally Prime: Small Business Accounting Software

Tally Prime is a robust accounting software solution designed to give you in-depth financial control for your business.

This small business accounting software excels in features such as multi-currency accounting, inventory management, invoicing and advanced taxation for Indian businesses and gain other valuable insights with Tally Prime's customizable reports

Tally Prime is an on-premise solution, that stores your information securely on your systems, giving you complete control over data security and privacy.

Some unique features of Tally Prime are:

☑ Simplified MSME Payments

☑ Powerful Dashboards

☑ WhatsApp Integration

Tally Prime Accounting Software Features

Simple accounting system with powerful features for small buinesses

Invoicing & Accounting

TallyPrime simplifies creating GST-compliant invoices, customizable with logos and additional information. It supports various invoice types, multiple billing formats, and multi-currency transactions. Users can share invoices via WhatsApp, integrate payment QR codes, and maintain multiple addresses. Features include automatic receivables management, flexible pricing, and seamless multitasking.

Inventory Management

It allows businesses to define unlimited groups, categories, batches, and locations for inventory management. It supports flexible units of measure, manufacturing journals, and comprehensive bills of material. Features include reordering levels, multiple stock valuation methods, job work management, and expiry date tracking, along with detailed inventory reports and job costing capabilities.

Credit & Cash Flow Management

It streamlines receivable and payable management with unique bill references, ageing analysis, and MSME payment tracking. It supports multiple bill settlements, automatic interest calculations, and comprehensive cash and funds flow reports. Features include credit control, cash flow projections, reminder letters, payment performance reports, and integration with payment gateways for QR code generation.

E-Invoicing

TallyPrime facilitates instant generation of e-invoices seamlessly integrated with IRP, including bulk invoicing and e-way bill generation. It offers detailed e-invoice reports, online cancellation capabilities, and supports offline mode for uninterrupted operations. Additional features include alert mechanisms for data integrity and comprehensive GST reporting and reconciliation.

Taxation & Complainces

The software simplifies GST compliance and filing with features like instant e-invoice generation, e-way bill management, and MSME payment compliance tracking. It automates GSTR reconciliation, supports multi-GSTIN management, and ensures audit trail compliance. Features include TDS/TCS management, seamless updates for regulatory changes, and comprehensive reporting capabilities for GST returns and statements.

Banking

TallyPrime simplifies banking operations with automated bank reconciliation for over 100 banks. It offers features like cash deposit slip generation, comprehensive cheque management with multiple chequebooks, and secure e-payments via e-Fund Transfer and Electronic Cheque/DD/PO. The system supports pre-defined cheque printing formats and ensures timely updates for new bank formats, enhancing efficiency and security in financial transactions.

Cost Control & Analysis

Cost Centre and Profit Centre Management in TallyPrime allows easy setup of cost units and provides instant reports for comparative analysis across periods and centres. Users can set budgets at various levels, track variances, and improve business forecasting with simulated scenarios. Additional features include multiple cost categories, job/project cost tracking, and pre-defined cost/revenue allocations.

Net Capabilities

The net capabilities features in TallyPrime revolutionize business operations with its integrated services for e-way bill and e-invoice generation, leveraging ISO-certified GSP status for seamless compliance. It facilitates instant communication via WhatsApp for sharing invoices and reports. Secure remote access ensures flexibility to view and manage critical business reports from any device. The system integrates with payment gateways for digital payment requests and supports e-banking transactions with major banks. It also offers decentralized data synchronization across multiple branches, enhancing operational efficiency and data security.

Payroll Management

TallyPrime simplifies payroll management by automating processes and handling exceptions effortlessly. It supports multiple employee group classifications and flexible attendance/production types. The system ensures statutory compliance with reports for PF, ESI, professional tax, gratuity, and income tax. Additional features include customizable pay-outs, various calendar types, and generation of monthly returns and annual statements for comprehensive payroll management.

Enhanced Security

This ensures data security with TallyVault encryption, offering multiple security levels and user management features. It includes audit trails for tracking all changes, from transactions to master data. A robust password policy strengthens security by enforcing password strength, expiry, and history management, ensuring authorized access and data integrity.

Others

TallyPrime simplifies data management with Excel imports, ensuring seamless mapping and error correction. It supports digital signatures for PDF invoices and reports, enhancing document authenticity. Multilingual capabilities cater to diverse business needs, while features like multi-company support and easy data backup ensure comprehensive business management and compliance.